Inflection Solver

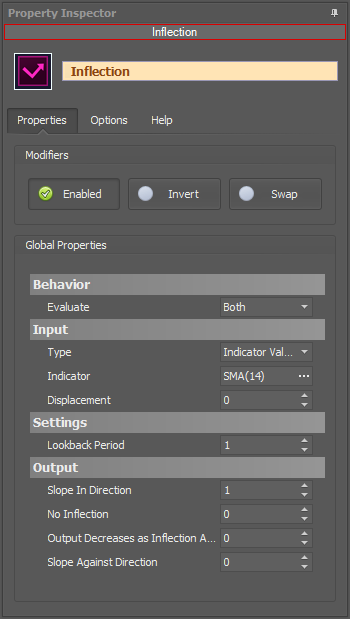

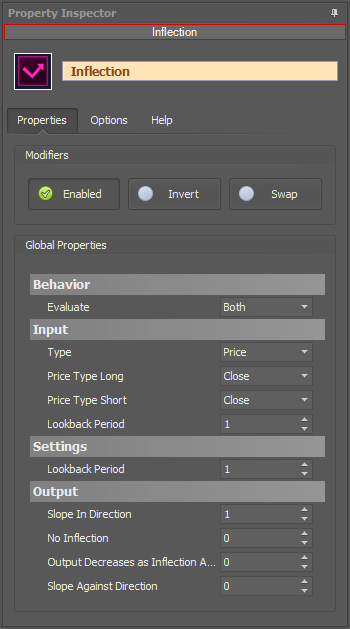

The Inflection solver gives a signal when a reversal in slope occurs. This is the point at which an indicator reverses direction, known as an inflection point.

BloodHound v2

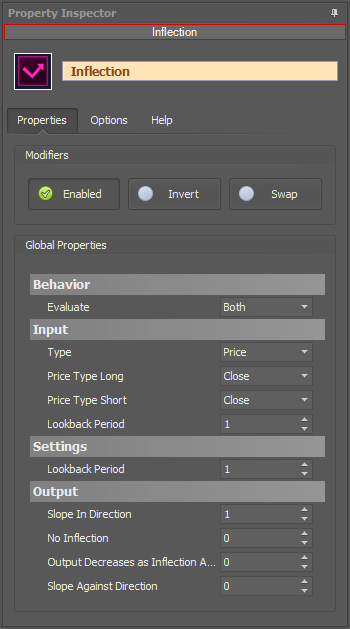

Properties tab

This section provides quick access to commonly used output modifiers.

Please note: The buttons only modify the individual instance of the selected node(s) on a Logic Board. Thus, the buttons are only visible when a node is selected on the Logic Board. The buttons are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is consistent with adding a function node afterwards, so that the original solver's output remains unmodified elsewhere in the system. It is similar to having an SMA(50) on several charts. Changing the plot color on one chart does not modify the plot color on the other charts.

Global Properties

Global Properties

Behavior

Input

This section determines what kind of data the solver will evaluate. Use the Type drop-down menu to select the data type.

The menu will change based on which data type is selected. Click on Type to see the various data types available and the corresponding documentation.

The Input section determines the data type to be evaluated. Use the 'Type' menu to select the data type. See below for detailed information on each data type.

Type: Fixed Value

Type: Price

This option allows price data to be used in the solver. The price data can be shaped/manipulated by the various settings before it is used by the solver.

Custom Prices

SharkIndicators has custom system development prices that are very useful in reducing the number of solvers, and simplifying system logic, when evaluating the open and close (body) prices.

Body Top: Regardless of the bar direction, this returns the upper price of the candlestick body. Either the close or open price. Whichever is on top. e.g. For an up bar, the Body Top equals the close price.

Body Median: This returns the median price of the candlestick body. The formula is (Close + Open) ÷ 2.

Body Bottom: Regardless of the bar direction, this returns the lower price of the candlestick body. Either the close or open price. Whichever is the bottom. e.g. For an up bar, the Body Bottom equals the open price.

Type: Volume

Volume will feed the current bar volume into the solver.

To evaluate the volume from a few bars back, use Indicator Value. Then select the VOL indicator, and use the Displacement setting.

Type: Indicator Value

Type: Swing Point Prices

Swing Point Prices uses the Swing Highs & Lows indicator plots for input price data. This is useful when you need to access the lowest low or highest high prices from the latest swing point.

You can add the bundled indicator Swing Highs & Lows to the chart to help you visualize the price data the solver is using.

Type: Linear Regression Channel

Selecting Regression Channel allows you to use the Regression Channel Upper, Middle, or Lower line as input to the solver. This may be useful if you need to compare an indicator or price to one of the Regression Channel lines. Select which channel lines to use as input for the long and short evaluations separately, with a choice of the Upper Channel Line, Middle Channel Line, or Lower Channel Line.

Note: Using the Regression Channel for slope related solvers (Slope, Change in Slope, and Inflection solvers) do not have a channel selection since the slope for all channel lines are always the same. As you may expect, the slope of the channel line is what is evaluated, which is the same as using the 'Lin. reg. slope' indicator for the input.

Settings

Output

Options tab

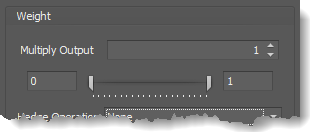

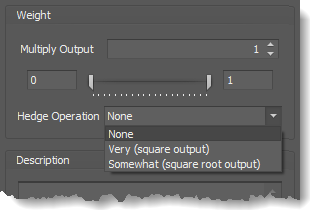

This section is used to modify the node's final output value. It is only useful for designing fuzzy logic systems, or a fuzzy logic section of a system.

Please note: The Weight controls only modify the individual instance of the selected node(s) on a Logic Board. Thus, the Weight controls are only visible when a node is selected on the Logic Board. The controls are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is different than BloodHound 1.0. In BH 1.0, the Weight controls modified the nodes output globally (every instance). This change in BH 2.0 adds more system design granularity.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Note: The final output will not exceed a value of 1, as described in the Slider control below.

Slider control: The slider constrains the final output to a value of 0 to 1. The left side of the slider sets a minimum value that is output regardless if the solver condition is true or not. The right side sets a maximum value that is output. The output is capped.

e.g. Three indicator conditions are being checked, and thus three solvers are created. Only two out of the three indicator conditions are needed. An Additive logic node is used to add the solver's outputs together. Just two out of the three solvers need to add up to a value of 1. Therefore, the right slider (max output value) for all three solvers is set to 0.5. When two indicator/solver conditions are found, thus the outputs = 0.5, then the calculation, in the Additive node, is 0.5 + 0.5 + 0 = 1. A value of 1 means the two out of three condition is true.

Hedge Operation: This applies a mathematical formula to the internal value.

Hedge Operation: This applies a mathematical formula to the internal value.

None: No modification is applied.

Very (square output): A squaring formula is applied. Output = value^² .

Somewhat (square root output): A square root formula is applied. Output = √value .

Description

Description

This text area provides a place to write a full description of what the node is doing, used for, or what ever you want.

Note: The Description is global to all instances of the node. It is not applied individually to each instance as the Weight controls are.

Help tab

This tab displays the documentation page (from this web site) of the selected node.

Please note: NinjaTrader v8.0.26.0 or newer is required for the built in web viewer to work, and thus the documentation to be displayed.

Video Tutorial

Examples

Example 1: The Basics

This demonstrates the basic function of the Inflection solver with the use of the SMA. This solver will be used to detect a change in direction.

- Add the Inflection solver to the Logic Board, and connect to the Result node

Example 2A: Price Reversal

This shows how the Inflection solver identifies price reversals. The solver will be used to identify a change in direction of the BacktestRenko bar. This works on other bar types as well.

- Add the Inflection solver to the Logic Board, and connect to the Result node

- Set Input » Type to Price

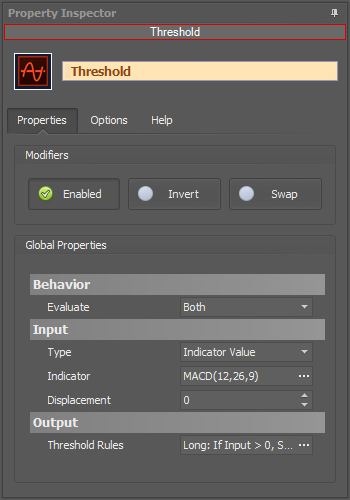

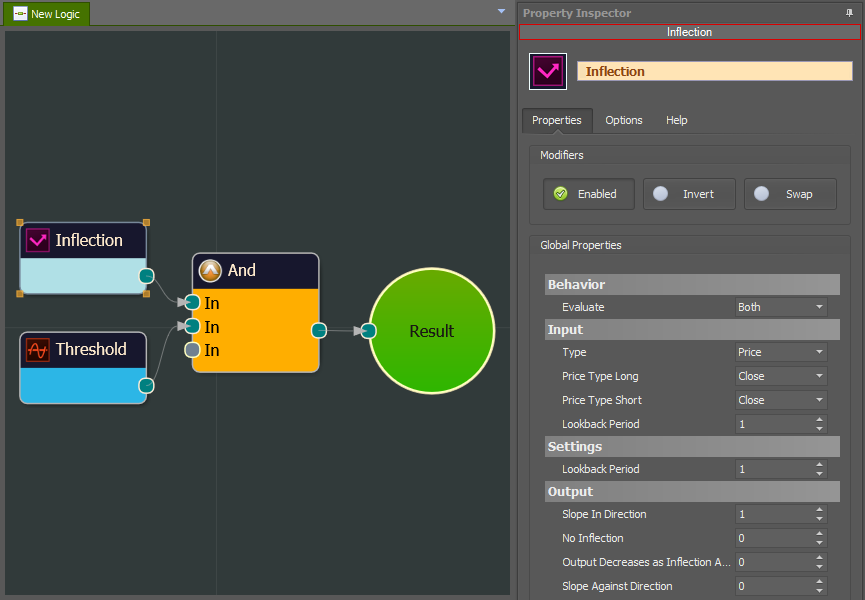

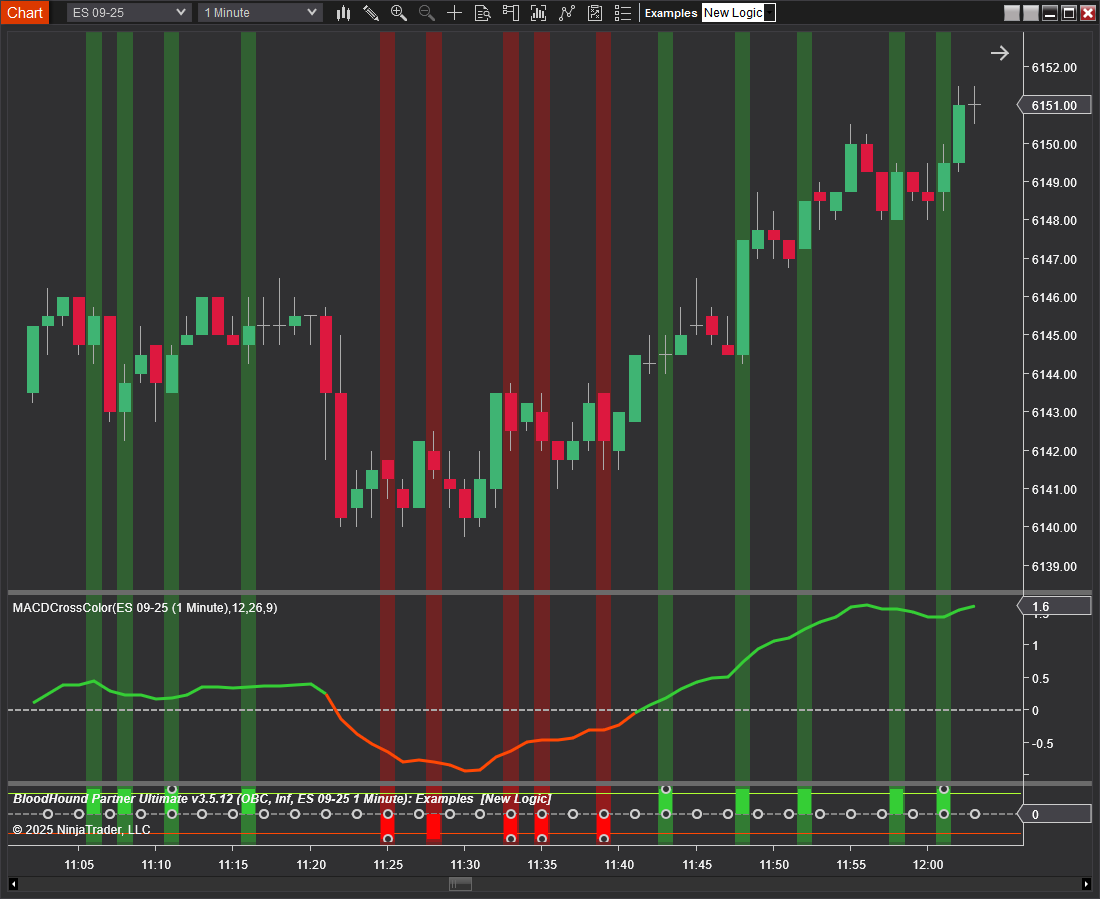

Example 2B: Price Reversal and MACD Filter

This demonstrates filtering price reversals using the MACD line. When the MACD line is above zero (positive) only long price reversals will show, and when the MACD line is negative only short price reversals will show.

- Add the Inflection solver to the Logic Board, and connect to the Result node

- Set Input » Type to Price

- Add the Threshold solver (the filter) to the Logic Board, and connect to the Result node

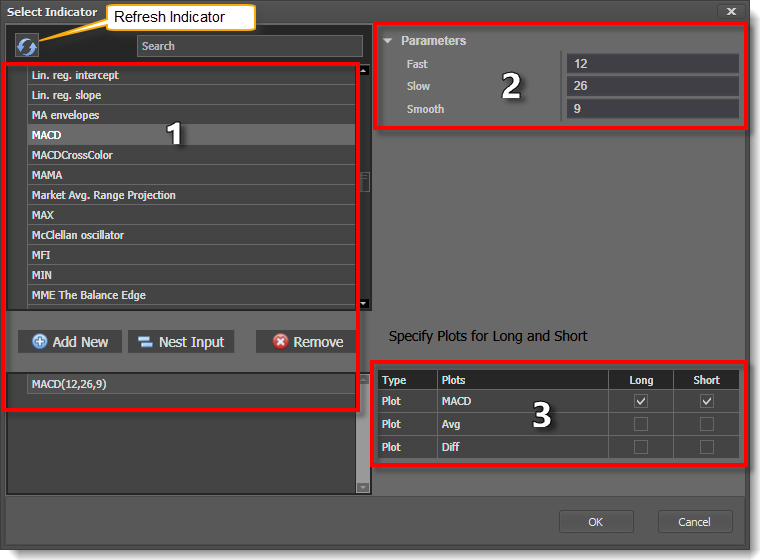

- Set Indicator to the MACD

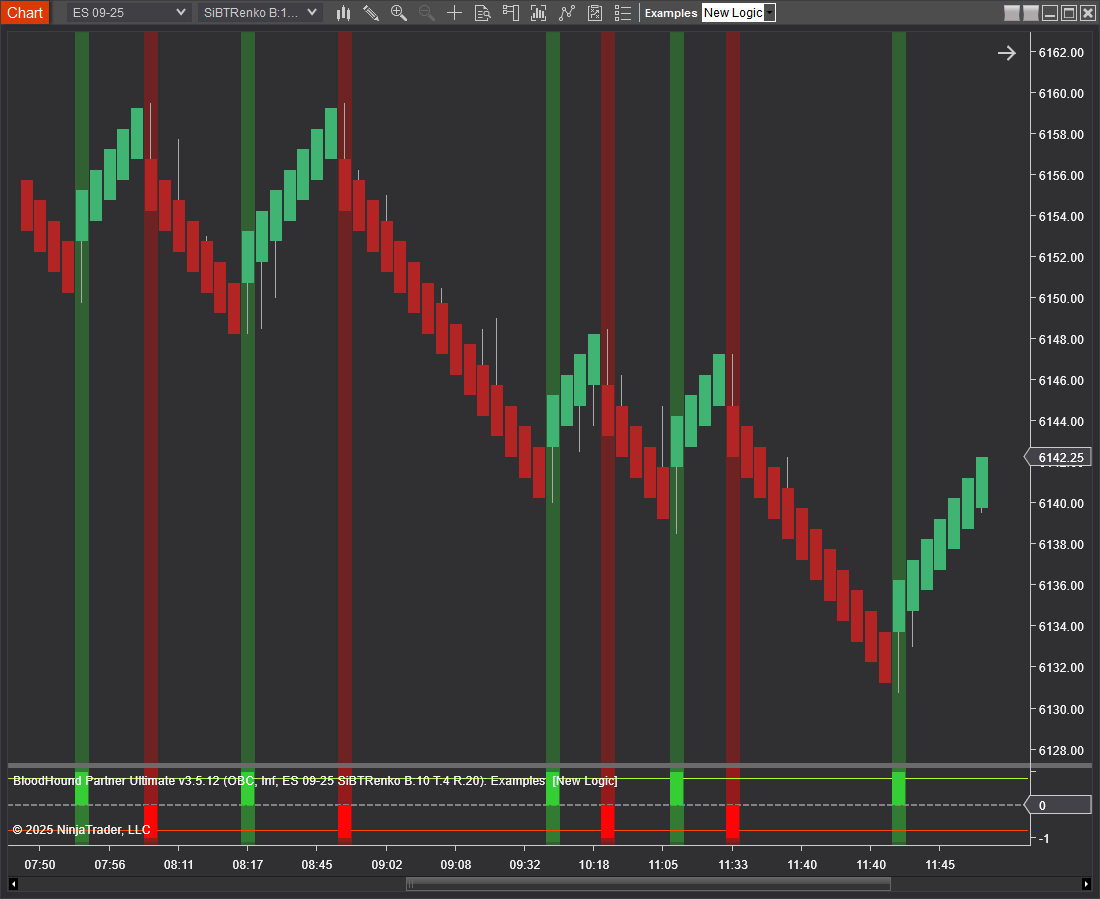

The chart shows a long output when the MACD line is above zero and a short output when below zero, from the Threshold solver.

Combining with a AND node

Now lets combine the Inflection and Threshold solvers with a AND node, then observe how the output change.

- Add a AND node to the Logic Board

- Connect the Inflection and Threshold solvers to the NAD node, as seen in the image

- Connect the AND node to the Result node

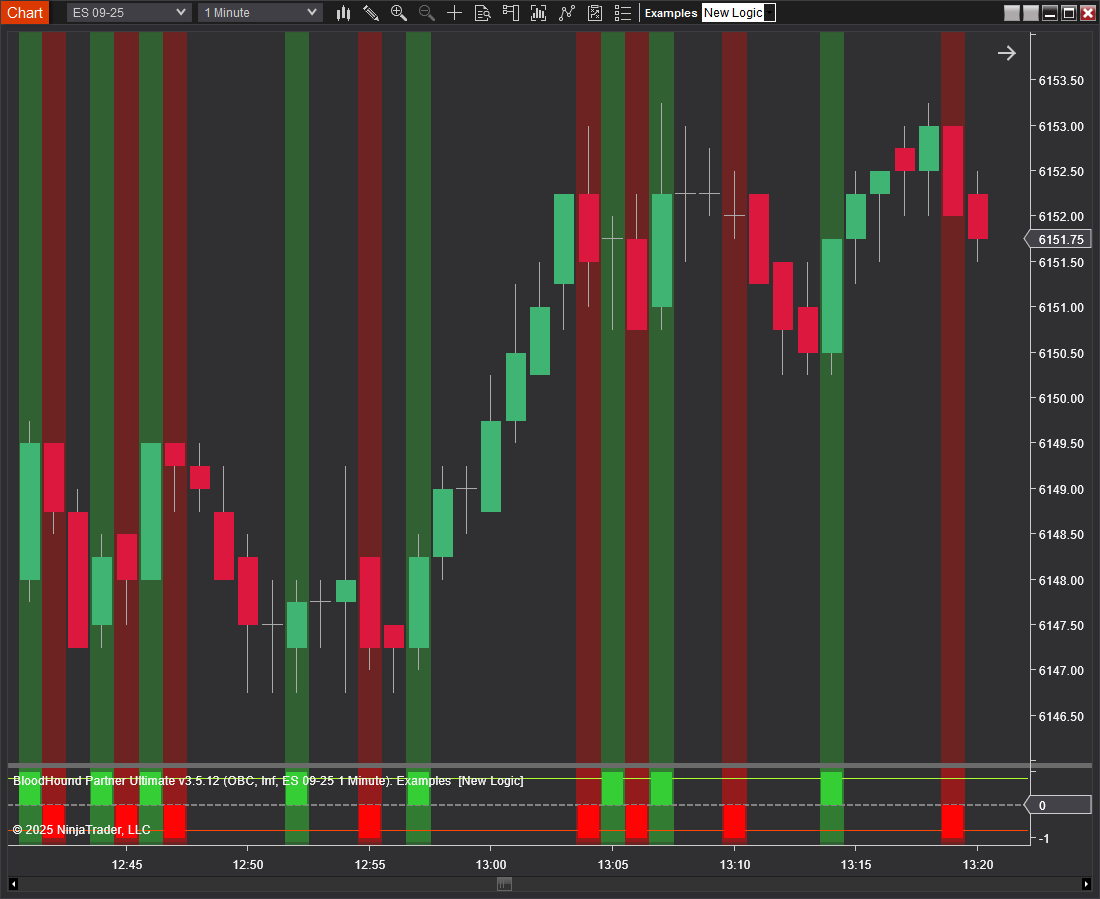

On the chart we see the AND node only allows the price reversal signals that match the MACD above or below zero filtering to pass through.

BloodHound v1

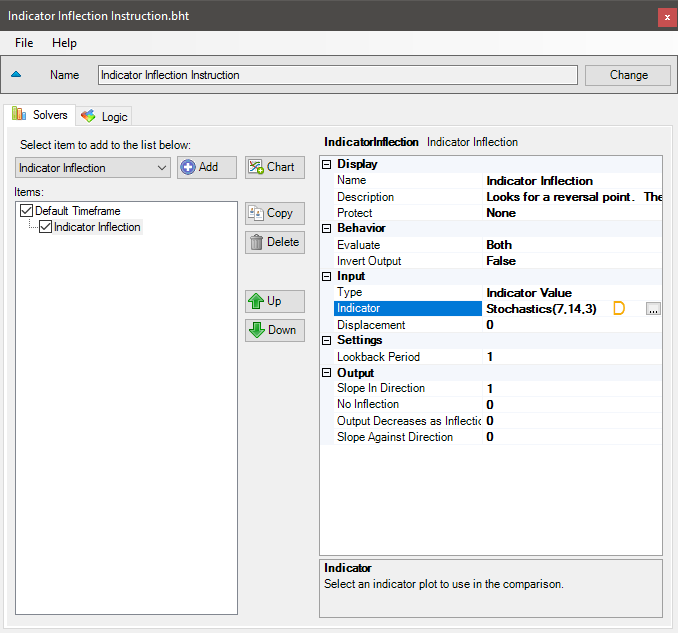

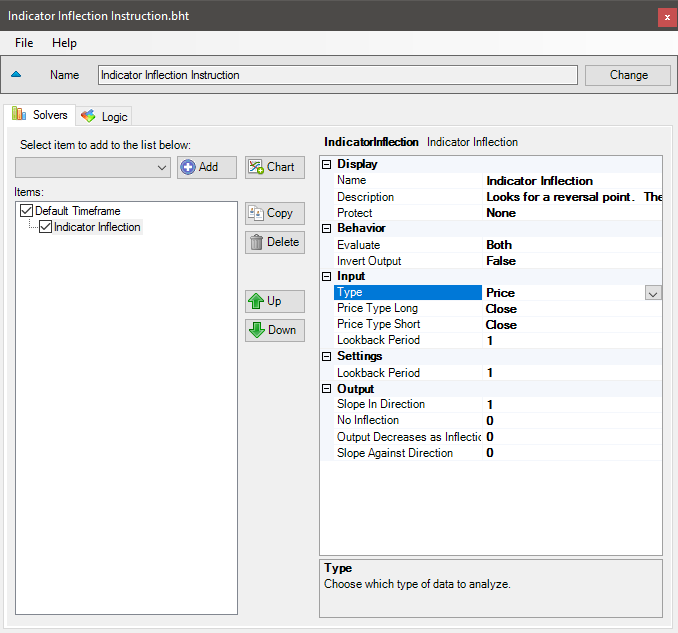

Indicator Inflection Solver

Parameters

Input

Settings

Output

Video Tutorial

This video is from our weekly Workshop titled Solvers 4-5-6, on Aug 22nd, 2012.

For more benefit please watch in full screen mode, as this video is recorded in HD.

This video is a snippet from the workshop on January 6, 2017. Find all workshop recordings here.

Examples

Example 1: The Basics

This demonstrates the basic function of Indicator Inflection solver with the use of the Stochastic D. This Solver will be used to detect a change in direction.

- Add the Indicator Inflection solver

- Set Indicator > Indicator to Stochastic D

In the chart below notice the signals given when the Stochastic makes an S curve on the way up in the middle of the chart.

Example 2: Price Reversal

This demonstrates the basics of finding a Price reversal using the Indicator Inflection solver. This Solver will be used to detect a change in direction of the ProRenko bar. This will work on other bar types as well.

- Add the Indicator Inflection solver

- Set Indicator > Type to Price with Price Type Long/Short set to Close