Regression Channel Position Solver

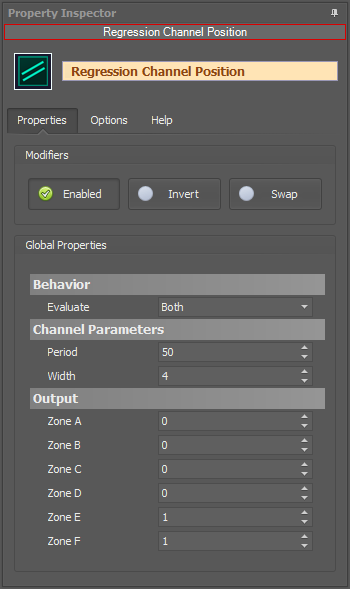

The Regression Channel Position solver analyzes the relative position of price to the Regression Channel lines. The Regression Channel is divided into 6 zones (A-F). 4 zones are inside the channel, and 2 zones are outside the channel. Output Zones for the Long side start above the Upper channel line with Zone A and descend. Output Zones for the Short side start below the Lower channel line with Zone A and ascend. See the examples below for a visual explanation.

BloodHound v2

Properties tab

This section provides quick access to commonly used output modifiers.

Please note: The buttons only modify the individual instance of the selected node(s) on a Logic Board. Thus, the buttons are only visible when a node is selected on the Logic Board. The buttons are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is consistent with adding a function node afterwards, so that the original solver's output remains unmodified elsewhere in the system. It is similar to having an SMA(50) on several charts. Changing the plot color on one chart does not modify the plot color on the other charts.

Global Properties

Global Properties

Behavior

Channel Parameters

Output

Options tab

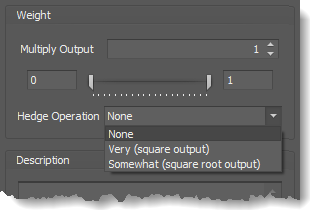

This section is used to modify the node's final output value. It is only useful for designing fuzzy logic systems, or a fuzzy logic section of a system.

Please note: The Weight controls only modify the individual instance of the selected node(s) on a Logic Board. Thus, the Weight controls are only visible when a node is selected on the Logic Board. The controls are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is different than BloodHound 1.0. In BH 1.0, the Weight controls modified the nodes output globally (every instance). This change in BH 2.0 adds more system design granularity.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Note: The final output will not exceed a value of 1, as described in the Slider control below.

Slider control: The slider constrains the final output to a value of 0 to 1. The left side of the slider sets a minimum value that is output regardless if the solver condition is true or not. The right side sets a maximum value that is output. The output is capped.

e.g. Three indicator conditions are being checked, and thus three solvers are created. Only two out of the three indicator conditions are needed. An Additive logic node is used to add the solver's outputs together. Just two out of the three solvers need to add up to a value of 1. Therefore, the right slider (max output value) for all three solvers is set to 0.5. When two indicator/solver conditions are found, thus the outputs = 0.5, then the calculation, in the Additive node, is 0.5 + 0.5 + 0 = 1. A value of 1 means the two out of three condition is true.

Hedge Operation: This applies a mathematical formula to the internal value.

Hedge Operation: This applies a mathematical formula to the internal value.

None: No modification is applied.

Very (square output): A squaring formula is applied. Output = value^² .

Somewhat (square root output): A square root formula is applied. Output = √value .

Description

Description

This text area provides a place to write a full description of what the node is doing, used for, or what ever you want.

Note: The Description is global to all instances of the node. It is not applied individually to each instance as the Weight controls are.

Help tab

This tab displays the documentation page (from this web site) of the selected node.

Please note: NinjaTrader v8.0.26.0 or newer is required for the built in web viewer to work, and thus the documentation to be displayed.

Video Tutorial

This video is from our weekly Workshop on July 11, 2024.

For more benefit please watch in full screen mode, as this video is recorded in HD.

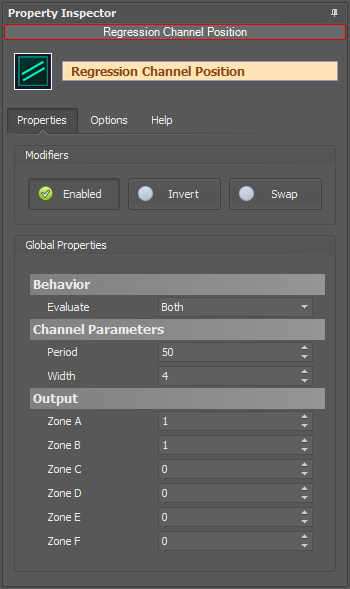

Examples

Example 1A: The Basics (Counter Trend)

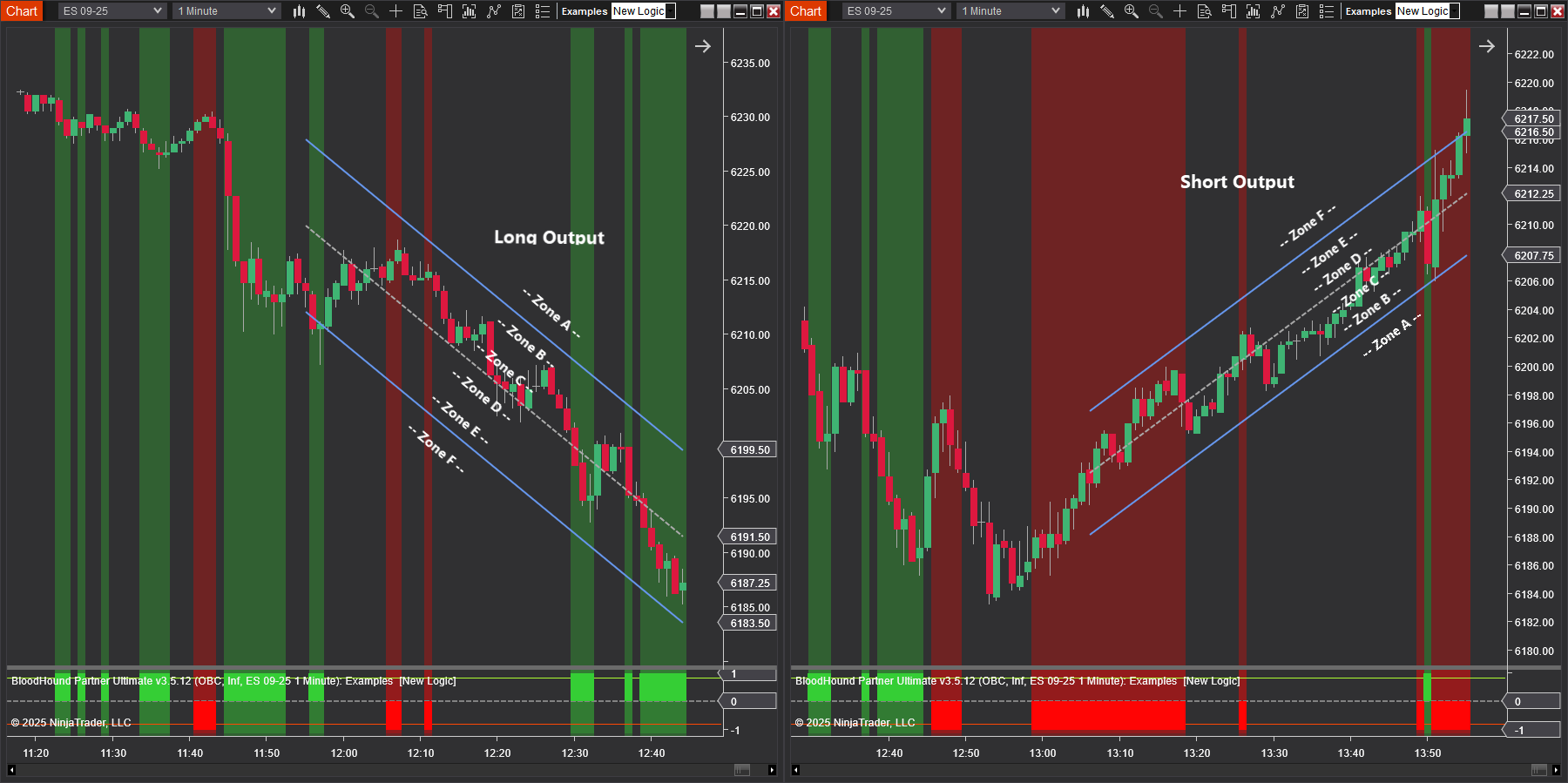

This demonstrates the basic function of the Regression Channel Position solver, and how Long & Short Output Zones are inverted.

- Add the Regression Channel Position solver to the Logic Board, and connect to the Result node

- Set Output » Zone A, B, C, & D to 0

This chart shows the default counter trend outputs for Zone E and F. On the left, when price enters Zone E or lower for long outputs the solver outputs 1 to the Long Confidence plot. On the right, notice the Zones are reversed. Thus, when price enters the short output Zone E or higher the solver outputs 1 to the Short Confidnece plot.

Click image to enlarge.

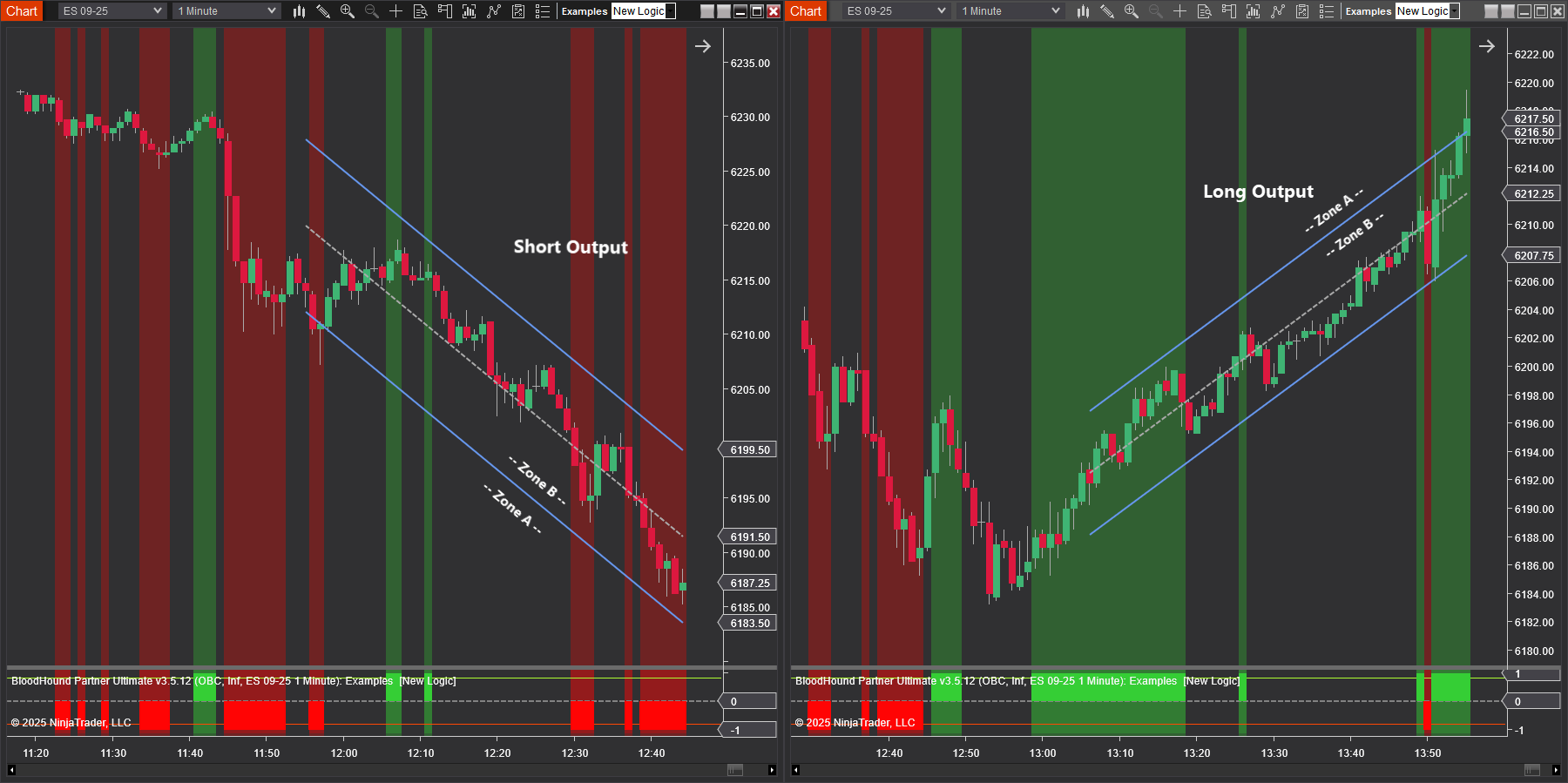

Example 1B: The Basics (WithTrend)

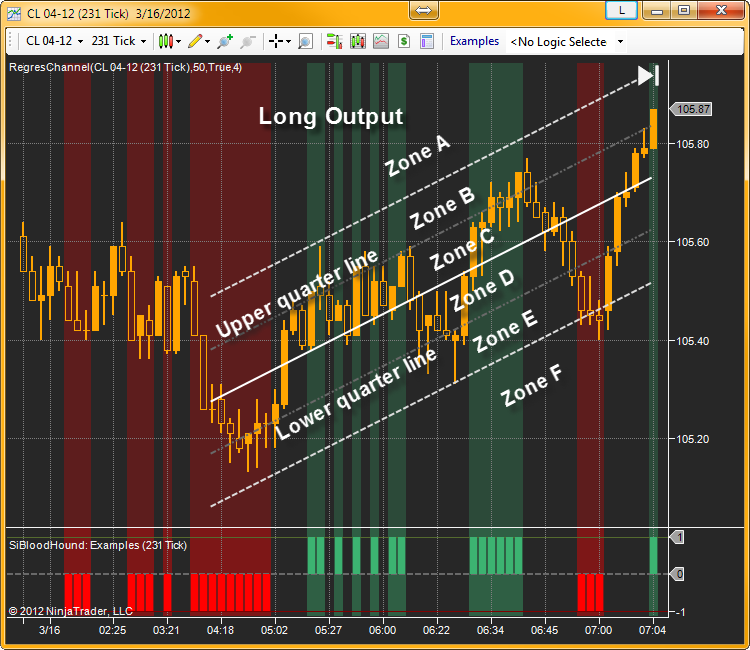

This second part illustrates using the opposite Zones, which produces signals in the direction of the short term trend. When Zone A and B are set to 1 and price goes above the upper quarter line (between Zone C and Zone B) a long output occurs. The reverse is true for the Short side, because the Output Zones are inverted. Therefore when price is below the lower quarter line a short output occurs.

- Add the Regression Channel Position solver to the Logic Board, and connect to the Result node

- Set Output » Zone A & B to 1

- Set Output » Zone C, D, E, & F to 0

In this chart all the outputs are reversed and the short output is now on the left verses chart 1A above. The Outputs for Zone A and B produces an output in the direction of the near term trend.

Click image to enlarge.

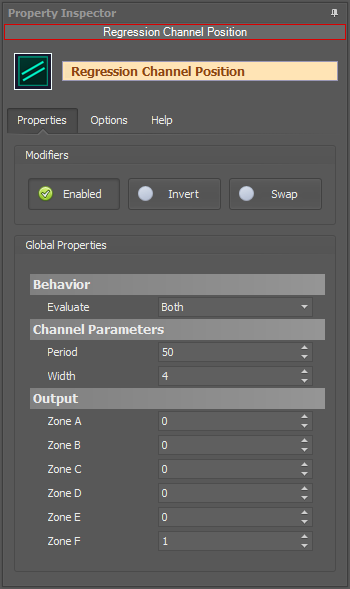

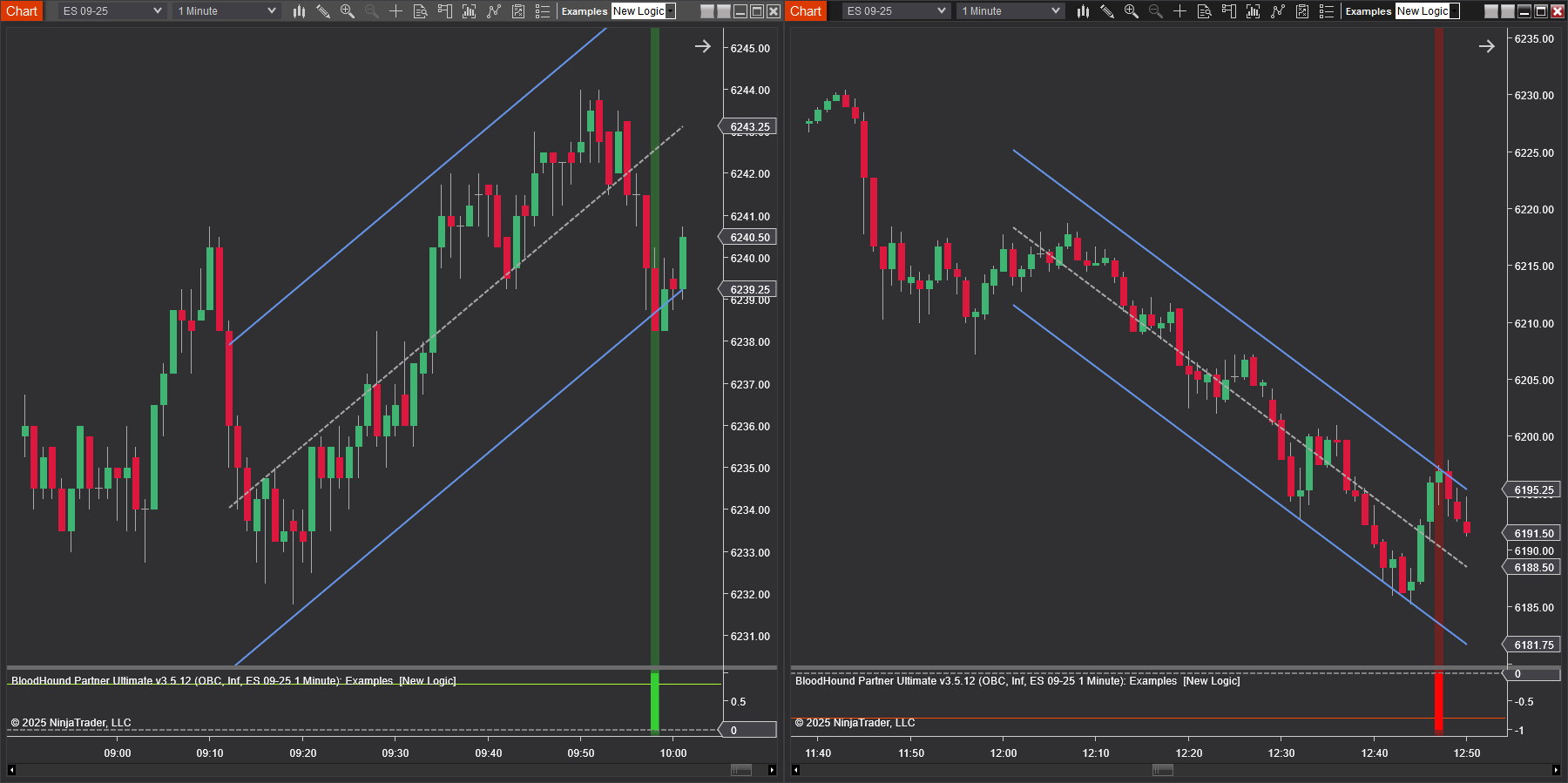

Example 2: Slope Filtered Signals

This example generates a long signal when price exceeds the bottom channel line and the channel is sloping up, and a short signal when price exceeds the upper channel line and the channel is sloping down.

- Add the Regression Channel Position solver to the Logic Board, and connect to the Result node

- Set Output » Zone A, B, C, D, & E to 0

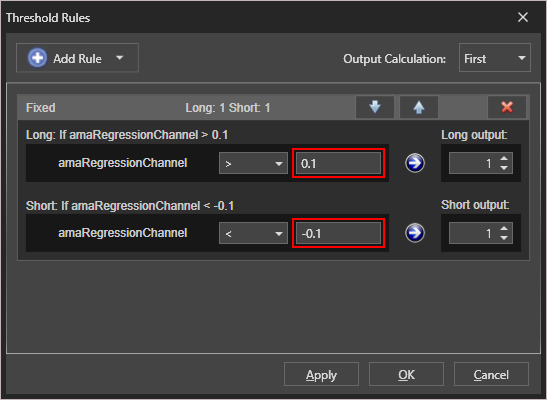

This Threshold solver will determine if the Regression channel is sloping up or down to filter the signals.

- Add the Slope solver to the Logic Board, and connect to the Result node

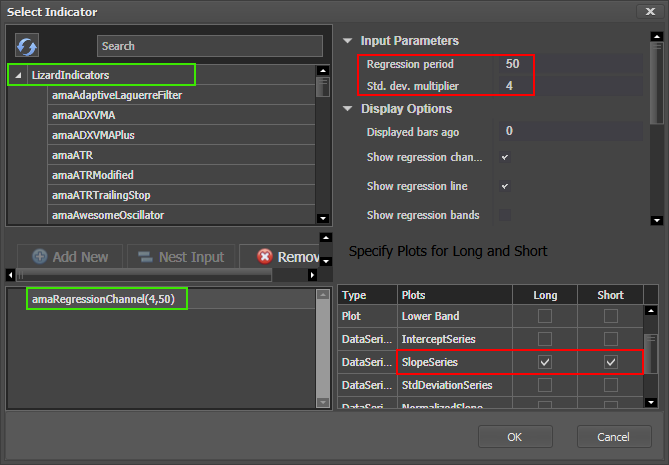

- Set Input » Type to Linear Regression Channel

- Set Regression Period to 50

- Set Width in Deviations to 4

- Set Long Evaluation and Short Evaluation to Middle Channel Line

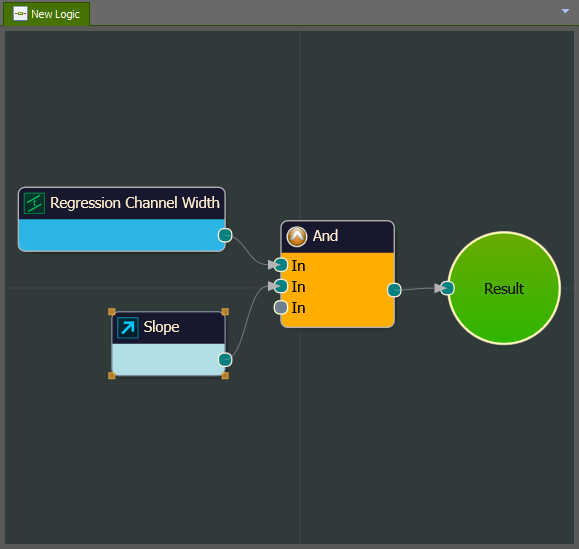

- Add a AND node to the Logic Board

- Connect the Regression Channel Position and Threshold solvers to the AND node, as seen in the image

- Connect the AND node to the Result node

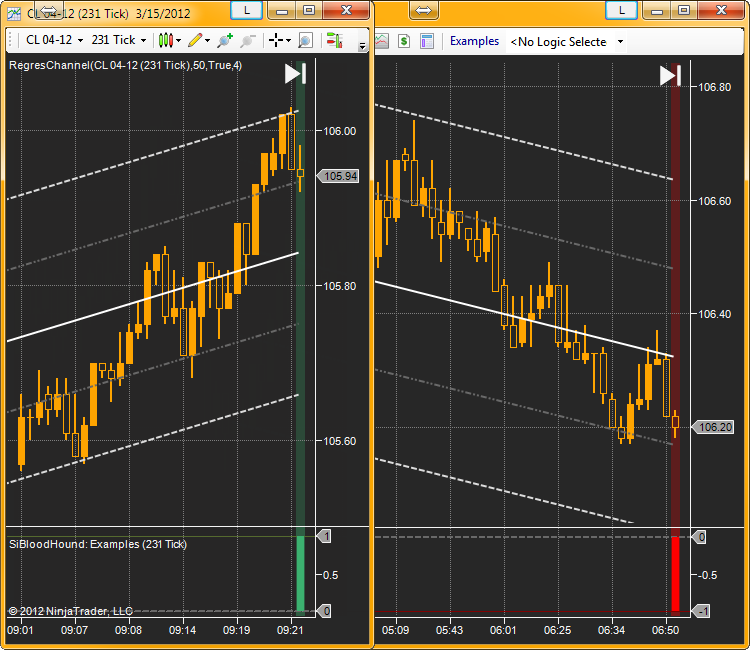

Below are two charts, side by side, illustrating the results of filtering with-trend regression channel signals.

BloodHound v1

Regression Channel Position Solver

Parameters

Channel Parameters

Output

Video Tutorial

This video is from our weekly Workshop on Aug 22nd, 2012.

For more benefit please watch in full screen mode, as this video is recorded in HD.

Examples

Example 1A: The Basics

This demonstrates the basic function of the Regression Channel Position solver, and how Long & Short Output Zones are inverted. When Zone B is set to 1 and price is between the upper quarter line and Upper channel line the Long output is 1. The reverse is true for the Short side, because the Output Zones are inverted. Therefore when price is between the lower quarter line and Lower channel line (Zone B for the Short side) the Short output is 1.

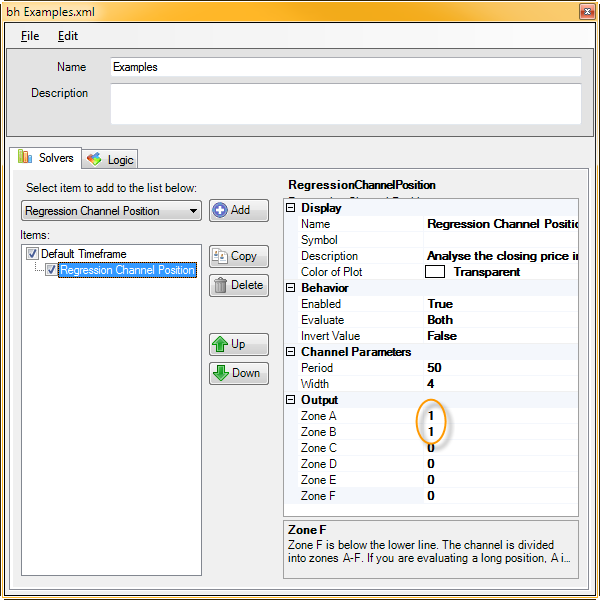

- Add the Regression Channel Position solver

- Set Output Zone A & B to 1

- Set Output Zone C, D, E, & F to 0

As seen in the top chart, when price enters the Long Output Zone B the solver outputs 1 to the Long side. In the bottom chart you will notice that the Zones are reversed. Thus, when price enters the Short Output Zone B the solver outputs 1 to the Short side.

Example 1B: The Basics

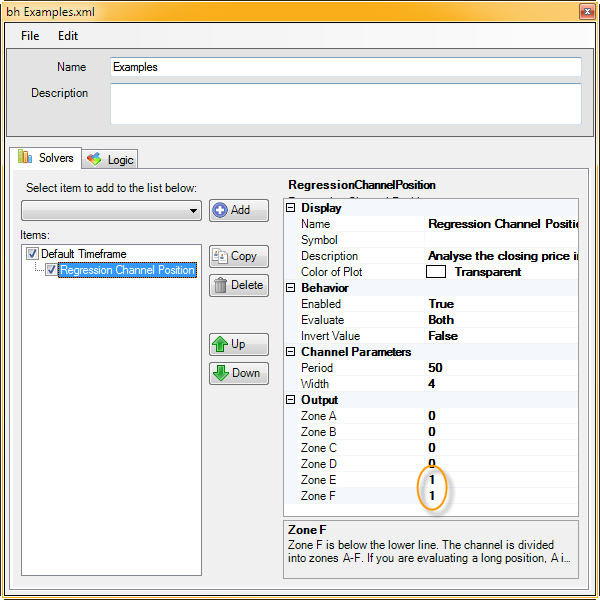

This second part will illustrate using the lower portion of the Output Zones.

- Add the Regression Channel Position solver

- Set Output Zone B, C, & D to 0

As seen in the top chart, when price enters the Long Output Zone E the solver outputs 1 to the Long side. In the bottom chart, when price enters the Short Output Zone E the solver outputs 1 to the Short side.

Example 2: Channel Entry & Exit

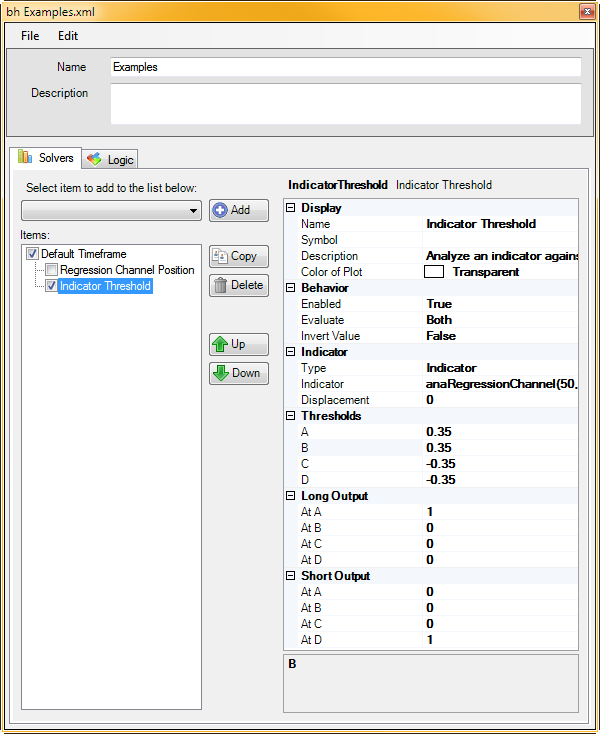

In this example we will generate a Long signal when price is near the bottom channel line and the channel is sloping up, also a Short signal when price is near the upper channel line and the channel is sloping down.

- Add the Regression Channel Position solver, and use the setting as shown above

- Add the Indicator Threshold solver

- Set Thresholds A & B to 0.35

- Set Thresholds C & D to -0.35

- Set Long Output: At A to 1

- Set Short Output: At D to 1

Below we see two charts side by side, demonstrating the minimum slope requirement of the Regression Channel for a Long & Short output that the Indicator Threshold provides. Note that the Regression Channel Position solver is not checked for this image.

With the Regression Channel Position solver checked, the charts below show signals when the minimum slope is obtained and price is near one of the outer channel lines.